30+ Take Home Pay Calculator Alabama

Web If you make 55000 a year living in the region of Alabama USA you will be taxed 11342. That means that your net pay will be 43658 per year or 3638 per month.

College Career Act

Your average tax rate is 1167 and your marginal tax rate is 22.

. Simply enter their federal and state W. Take-home pay is what you have left after withholdings for taxes and. Web 30-Year Mortgage Rates.

Web The average annual salary is over 39000 18 as an average hourly rate across all jobs in Alabama State and its almost the same since 2009. 51 Arm Mortgage Rates. Web Calculate your Alabama net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free.

Web Alabama Paycheck Calculator. Web Salary Paycheck Calculator Alabama Paycheck Calculator Use ADPs Alabama Paycheck Calculator to estimate net or take home pay for either hourly or salaried. Web The Alabama Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2023.

Web Other useful paycheck calculators Employers in Alabama can use the straightforward calculator at the top of this page to calculate payroll and necessary tax. This free easy to use payroll calculator will calculate your take home pay. Web If you make 70000 a year living in Alabama you will be taxed 11428.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for. Web The Payroll Calculator will help you determine your estimated pay after taxes or take-home pay. It can also be used to help fill steps 3 and 4 of a W-4.

Web Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Web Utilize the Paycheck Calculator to obtain an ESTIMATED take home pay based on your inputs. Web Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Web Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Alabama. Supports hourly salary income and. Web Calculating your Alabama state income tax is similar to the steps we listed on our Federal paycheck calculator.

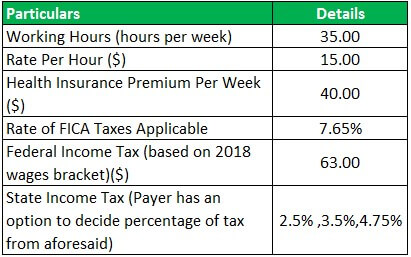

This calculator is only to be used as an estimate your actual take home pay is. Web The state income tax rate in Alabama is progressive and ranges from 2 to 5 while federal income tax rates range from 10 to 37 depending on your income. Figure out your filing status Work out your adjusted.

This marginal tax rate means that your.

Dawson S Mill In Prattville Al New Homes By Goodwyn Building

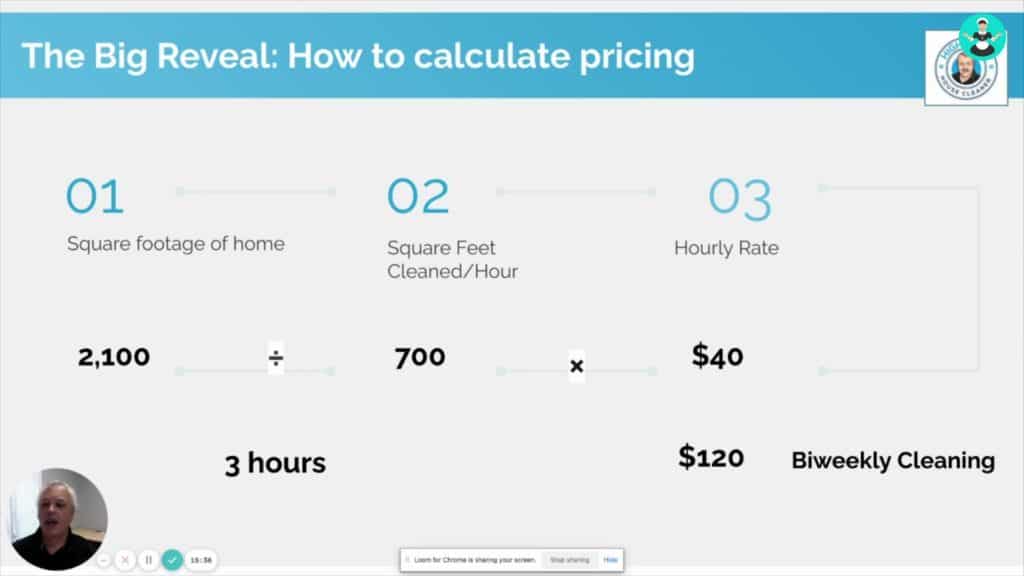

How To Create A Pricing System For Your Cleaning Business

Digital Identity Guidelines Authentication And Lifecycle Management Digital Benefits Hub

Alabama Salary Paycheck Calculator Gusto

Take Home Pay Definition Example How To Calculate

Vols Report Card Alabama

Office Of Financial Aid Scholarships Office Of Financial Aid

Alabama Salary Paycheck Calculator Gusto

Used Sedan Finance Specials Deals Anniston Al

Mckinnon Toyota Dealer Clanton Al Serving Hoover Al

What Jobs Are Paying The Most In The U S Right Now Quora

New Tax Law Take Home Pay Calculator For 75 000 Salary

105 Alabama Rd S Lehigh Acres Fl 33936 Trulia

13350 Highway 174 Odenville Al 35120 Realtor Com

2023 Military Pay Calculator

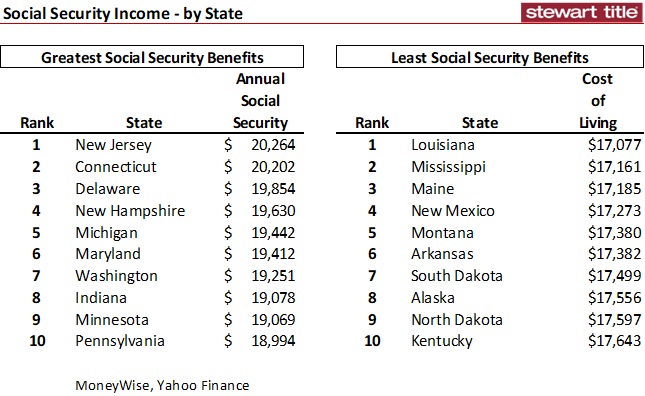

Another Top 10 List Which States Cost The Most And Least For A Single Renter Retiree To Live Social Security Benefits Average Income Shortfall

Va Home Equity Loan Options Veteran Com